“The problems do not point to a sustainable recovery”, they explain of Julius Baer

Will there be a cryptocurrency boom in 2023? This is the big question the market is trying to answer, but it’s not easy. The bankruptcy of FTX has put even more downward pressure on the “cryptos” after the “crash” of Terra last spring and the cumulative decline for the year amounts to more than 60%. As if that weren’t enough, the latest alert involving Binance has added even more doubt and uncertainty among investors. And of course, the data indicates that recovering digital assets can take longer than expected.

That’s according to Kelly Chia, Asian equity research analyst at Julius Baer, who notes that these problems are exacerbated by “difficult financial conditions in the traditional financial sphere.” “These problems still do not bode well for a lasting recovery,” said this expert, who points out that Binance has more than 52.9% of its reserves in ‘stablecoins’… despite the many withdrawals from them.

And it is that after the numerous outflows caused by Mazar’s test reserve report, Binance has temporarily frozen withdrawals of USD Coin (USDC), the second largest “stablecoin” in the market. According to data from StockApps.com, more than $3 billion in stablecoins such as Tether (USDT), USDC, Dai (DAI) or Binance USD (BUSD) have been withdrawn from the largest exchange on the planet over the past 30 last days. Similarly, other exchanges such as Bitrue or MEXC Global saw significant outflows, but far from Binance’s numbers.

“The increase in outflows of stablecoins from exchanges is likely due to traders seeking safer and more reliable stores of value. This suggests that many investors are choosing to keep their coins off-exchange, rather than leaving them vulnerable in a volatile market,” said StockApp financial analyst Edith Reads, who points out that the withdrawals seen on Binance give an idea of user confidence in the cryptocurrency colossus.

Data from blockchain analytics firm Nansen, for its part, is consistent in this sense: Binance’s outflows are alarming. “Over a month ago, Binance held approximately $69.5 billion in cryptocurrencies. Today, between large drawdowns and price swings, it holds approximately $54.7 billion,” they wrote. they said on their Twitter account a week ago. Nansen’s data is based on public Binance wallets. , including Bitcoin (BTC), Ethereum (ETH), BNB, Chain and Tron held by the company founded by Changpeng Zhao.

As if that wasn’t enough, after FTX went bankrupt, over 200,000 bitcoins left centralized exchanges (CEX) for cold wallets. “Transparency in exchanges is incredibly low and the reality is that it’s almost impossible to know what’s going on behind the scenes. The movement of bitcoin from these exchanges shows that customers are taking notice,” Max Coupland said. , responsible for ‘CoinJournal’.

“Like CEX, Binance must allow the exchange of many different tokens, but it is important to have a majority of reserves in BTC, ETH and stablecoins. Indeed, in times of risk, most users would exchange their cryptocurrencies against stablecoins to preserve their value. In the worst case, users will deposit a low-liquidity altcoin, exchange it for a stablecoin, and then withdraw it, leaving Binance to manage the deposited altcoin,” Chia explains.

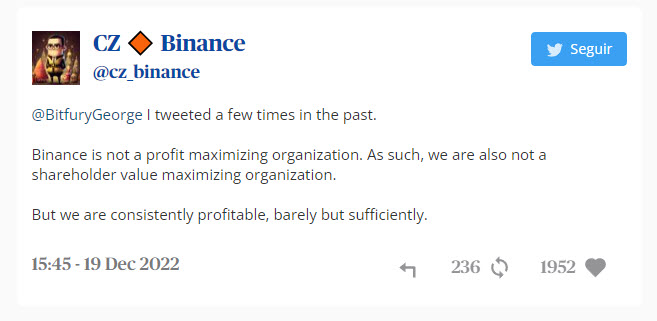

In recent days, Binance seems to have the situation under control and calm has returned to the platform, despite the fact that it continues to be under the spotlight of American justice. “I’ve tweeted this on other occasions. Binance is not a profit-seeking organization. As such, we are not a shareholder seeking to maximize organizational value. We are consistently profitable . Barely, but we are,” Zhao said in response to a user who mocked skeptics of the main exchange.

The truth is that Binance has been trying to differentiate itself from FTX in recent weeks, especially after it refused to acquire the platform in the days leading up to its collapse. However, its lack of transparency (we don’t even know where its headquarters are located) does not fully convince the market. Especially after the Mazar reserve test, although Zhao still insists that all deposits on Binance are backed 1:1 in dollars without any leverage.

Mazars, which also announced that it was ceasing to cooperate with companies in the sector. Likewise, Zhao assured that they have not approached to work with “Big Four” auditors and this group in turn does not seem to have any interest in working with companies in the “crypto” sector. “They rightly decided that the stakes were extremely high. They are very reluctant to enter the space, especially at a level of service below a full audit, which is the only appropriate level for this type of entity, in my opinion,” says a former PwC partner. In addition, the SEC has advised investors to be “cautious” about any audit that is not conducted in depth.

If the apparent lack of confidence in the sector wasn’t enough, other experts think it’s hard for us to see a positive market reaction in the coming weeks. Edward Moya, senior market analyst at Oanda, points out that the “gloomy outlook” presented by Micron and better-than-expected economic data in the United States “will support the Federal Reserve’s case to continue raising interest rates”. . “That should make investors nervous about profit cuts and credit risks,” he says.

Ryan Selkis, co-founder of the research firm Messari, believes that the Fed will only switch “when the recession really hits”. Others are more optimistic, like Bill Miller, who thinks bitcoin will improve its performance as the Fed shifts gears, or Tim Draper, who predicted bitcoin will hit $250,000 by 2023. , Binance’s former CFO Zhou believes Wei, Zhou Wei. there are still many days of wandering in the desert: “You have to prepare for a fairly long crypto winter.”