Bitcoin (BTC) is further than ever from its target price according to the Stock-to-Flow (S2F) model. We explain!

The price of Bitcoin (BTC) is like a roller coaster. This year alone, it has bounced from a high of $47,000 to trade at just over $16,600 today. Investors use Bitcoin’s Stock-to-Flow ratio to estimate future prices for the coin. But was he kind of wrong this time?

In any case, knowing when to buy at the best possible prices is every investor’s dream. And when it comes to Bitcoin (BTC), in a highly volatile market, even more so. That is why there are countless traders and analysts giving advice and gaining tens or hundreds of thousands of followers on social networks, who wait for the secrets of specialists to know when and how to enter the market.

For this reason, one of the analysts with the most conflicting opinions from the community is the well-known PlanB, the creator of the Stock-to-Flow predictive analysis model.

What is Stock to Flow?

For better understanding, the Stock-to-Flow model is commonly used to price commodities. As its name indicates, the model evaluates two attributes: stock and flow.

By the way, Stock is the total existing supply of a good. The flow is the new supply of merchandise that is created each year. Comparing these two attributes helps you assess the relative abundance of the commodity.

How is the model used for Bitcoin?

So, one of the most notable features of Bitcoin is that the precise amount of new supply that enters circulation each year is already known.

This means that Bitcoin Stock-to-Flow can be modeled with amazing accuracy. Unlike other commodities such as gold, which are based on less precise mining or supply estimates.

Is the Bitcoin Stock-to-Flow ratio a good model?

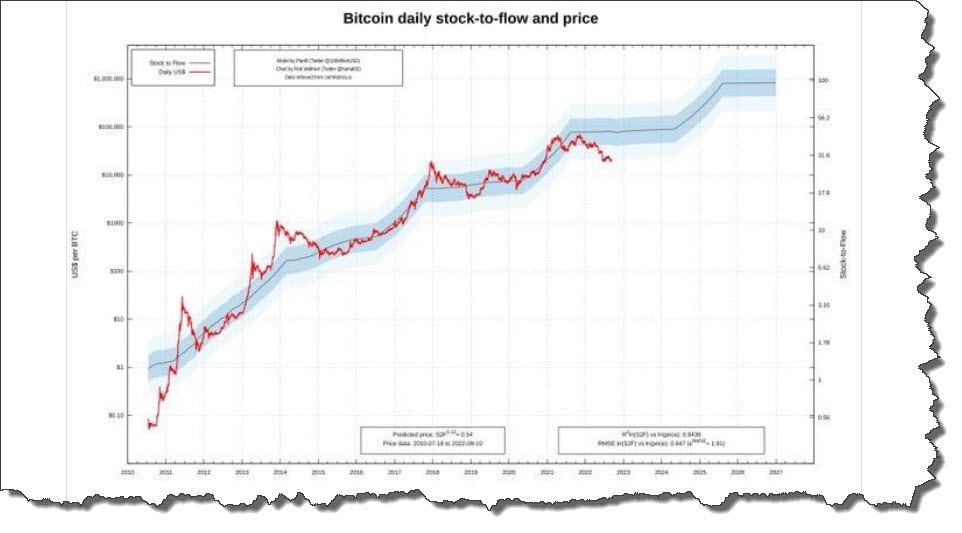

Indeed, the predictive ability of the Stock-to-Flow model for Bitcoin has proven its accuracy over the years.

Which is why, as Bitcoin skyrocketed during the pandemic, the model gained a lot of traction online due to its past accuracy.

In fact, there was a divergence between the price of Bitcoin and the Stock-to-Flow model in 2011 and 2013, before the rise of Bitcoin in mainstream investing. But between 2015 and the end of 2021, the model accurately predicted the price of Bitcoin. Although this time it was not.

S2F sets a new low

Now, an already negative trend has been reinforced by the continued decline in the price of BTC in the wake of the FTX controversy. This affects not only miners, but also some of Bitcoin’s best-known metrics, and has repercussions for many other essential parts of the Bitcoin network.

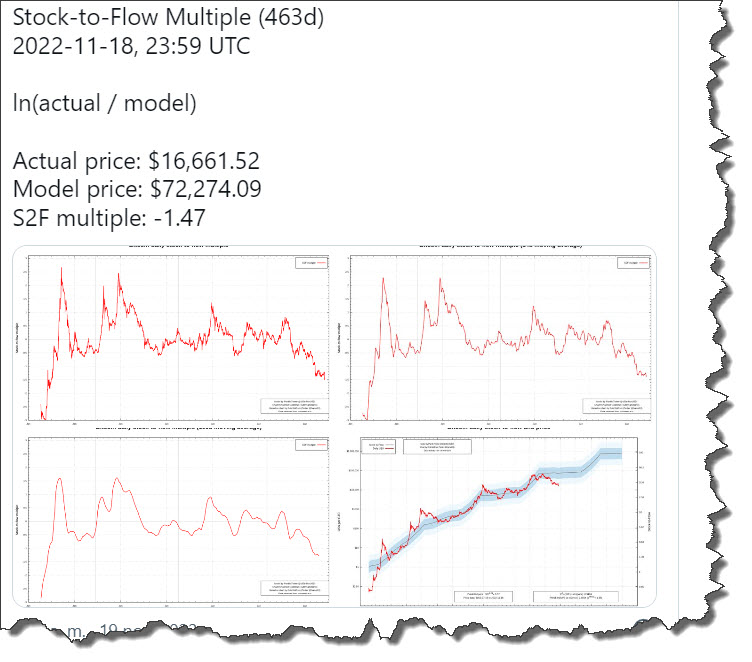

Specifically, one of them is Stock-to-Flow (S2F), whose price predictions are under increased scrutiny and criticism. While S2F is not “just up,” it allows for large price swings. However, even taking those factors into account, the current targets are still significantly higher than the current market price.

Specifically, on November 19, Bitcoin should be trading for just over $72,000, or a multiple of -1.47, according to dedicated tracking resource S2F Multiple. On November 10, when the market felt the effects of FTX, the multiple touched -1.5, a negative reading never seen before in S2F history.

In this regard, Philip Swift, creator of LookIntoBitcoin expressed:

«The price has now deviated more than ever below the S2F line. Currently a variance of -1.26 compared to the previous historical low of -1.21 back in 2011 ».

PlanB maintains its position

However, through a post on Twitter, the creator of the Stock-to-Flow analytics predictive model revealed that: “It feels like the world is ending. But FTX will probably just be a small blip on the radar in the long run.”

nterestingly, PlanB has received very strong accusations. These include claims that their base is fraudulent.

For example, Vitalik Buterin said: ‘I know it’s rude to gloat and all that. But I think financial models that give people a false sense of certainty and predestination that the number will rise are harmful and deserve all the ridicule they get.”

Finally, where will Bitcoin (BTC) go next? That is a very difficult question. And one of the most common ways to answer it is by looking at the Stock-to-Flow model? Leave your opinion in the comment box.

I say goodbye with this phrase from Andrés Tejero: «Bitcoin will rise like the Phoenix Bird. But first you have to hit rock bottom.”

I

Comments

One response to “Bitcoin sees the worst mistake of the Stock-to-Flow model!”

[…] Bitcoin sees the worst mistake of the Stock-to-Flow model! […]