The hackers who stole over $600 million from FTX continue to mobilize the stolen funds.

According to records in the Blockchain, the hackers responsible for the millionaire hack of FTX in November continue to mobilize the assets.

The group of hackers who stole more than $600 million from the FTX and FTX USA cryptocurrency exchange continue to mobilize the funds with the aim of laundering them.

It should be noted that curiously the theft happened a few hours after the exchange filed for bankruptcy on November 11.

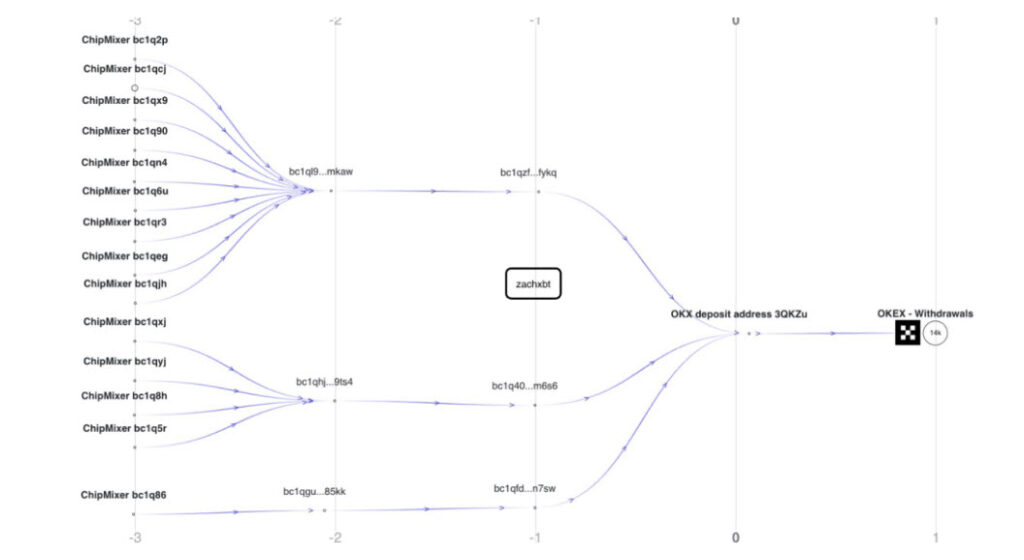

As indicated on Twitter by the pseudonymous Blockchain analyst ZachXBT, the hackers responsible for the FTX theft have transferred a portion of the stolen funds to the OKX exchange, after using the “ChipMixer” Bitcoin mixer. The analyst reported that approximately 225 BTC, valued at more than $4.1 million, have been sent to OKX so far.

Likewise, the data indicates that hackers began depositing BTC into the ChipMixer mixer on November 20. This after using the Ren Bridge, a protocol that acts as a connection between different Blockchains.

In the study that ZachXBT shared on Twitter, he indicated that he had observed a “pattern” with wallets receiving funds from ChipMixer. According to ZachXBT, each of the wallets follow a similar pattern, “50% is withdrawn from ChipMixer and then 50% is deposited with OKX.”

Shortly after ZachXBT’s post, the OKX director indicated that they “are aware of the situation” and will be investigating “the flow of transactions.”

It is important to note that during the FTX hack on November 11, the stolen funds were transferred to two wallets on Solana and Ethereum. Since then, hacker wallets have mobilized the funds to different Blockchains, such as Binance Smart Chain, Polygon, and Avalanche, according to reports.

FTX was in the hands of “inexperienced, unsophisticated and potentially compromised” people

On the other hand, bankruptcy specialist John Ray, who took over as CEO when FTX filed for bankruptcy, indicated that this is a situation that is “unprecedented.”

FTX’s new CEO, John Ray, said in a United States court filing that there was “flawed regulatory oversight” and a “lack of corporate control” by the bankrupt exchange founded by Sam Bankman-Fried.

Amid the collapse of the crypto ecosystem, FTX filed for bankruptcy protection in the United States on November 11. This after investors massively withdrew their assets from the exchange in less than three days and Binance abandoned a rescue agreement.

“Never in my career have I seen such a complete failure of corporate controls and a complete absence of reliable financial information as happened here.” Ray said in the document, which was filed with the bankruptcy court for the District of Delaware.

“From the integrity of compromised systems and flawed regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised people, this is a situation that is unprecedented,” added Ray in the document.

Notably, bankruptcy specialist John Ray did not name any specific regulators in his 30-page presentation.

Additionally, Ray confirmed that $372 million was transferred from FTX “without authorization” after filing the bankruptcy petition and noted that the exact positions of these stolen assets are not yet known. However, the expert added that they are working with restructuring consultants Alvarez & Marsal to resolve this situation.