New York — It’s been a rough, almost chaotic week for anyone involved in the crypto world, especially here in New York, where traders, analysts, hedge-fund folks, and retail investors have all been watching the markets with a mix of disbelief and exhaustion. Bitcoin, the big boss of digital currencies, has taken a heavy hit, dragging the entire crypto market down with it. And when Bitcoin trips, everybody feels the fall.

If you walk around Lower Manhattan, especially near the offices of the big trading firms, you can practically feel the tension in the air. People are glued to their screens in cafés, in co-working spaces, and even on the subway—refreshing charts that just keep sliding red. It’s that kind of week.

So what exactly happened? Why did the market lose about a trillion dollars in value over just six weeks, and why are investors suddenly running for the exits?

Let’s break it down the simple way.

A massive sell-off that nobody could ignore

For weeks, investors have been quietly pulling their money out of the market, but this week the trend exploded. The biggest shocker came from the U.S. Bitcoin ETFs, which had been a huge deal earlier in the year. Back in January, when the SEC finally approved spot Bitcoin ETFs, it felt like crypto had “made it.” Institutions were buying like crazy.

But November looked totally different.

Instead of new money flowing in, ETF providers reported around $3.7 billion in withdrawals this month alone—the biggest wave of rebalancing and cash-outs since the ETFs launched. If January felt like a warm welcome party, November has felt like an emergency exit.

For ETF managers here in New York, it’s been long nights and early mornings. One trader told reporters that the phones “haven’t stopped ringing.” People want out, or at least they want answers. And honestly, not many answers are comforting right now.

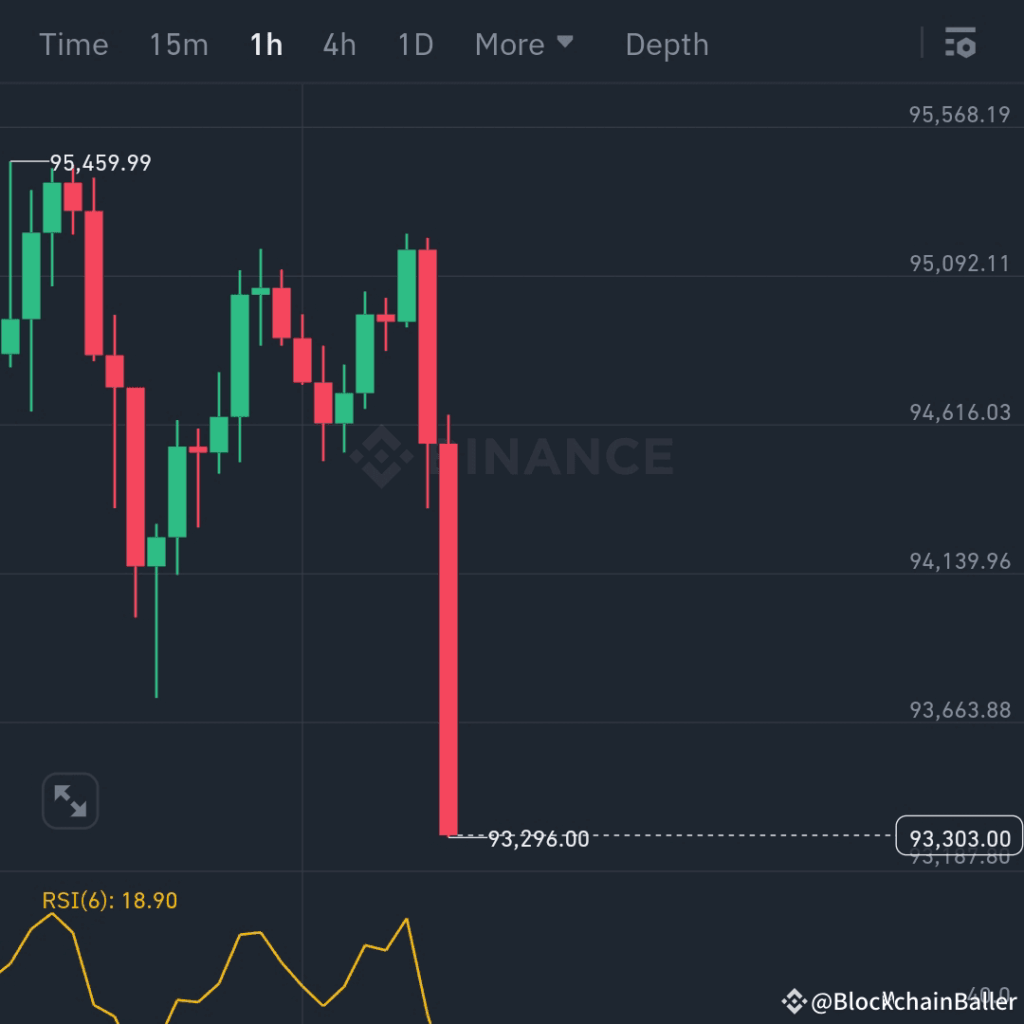

Leverage trades got crushed

On top of the ETF exits, another huge factor behind the crash was the amount of leverage sitting in the system. A lot of traders—especially younger ones on platforms that encourage high-risk bets—were trading with borrowed money, expecting Bitcoin to keep climbing forever.

But when the price dipped, even a little, those positions started getting liquidated automatically. And once liquidations begin, they trigger more liquidations. It’s like dominoes but with people’s savings.

This wave of forced selling added up fast: more than a billion dollars in Bitcoin leverage wiped out in a short window. For Ethereum and other altcoins, the story wasn’t much better.

On social media—especially on X—people were posting screenshots of their liquidation warnings and margin calls. You could practically hear the panic through the screen. New York-based influencer traders were livestreaming the downward spiral, trying to explain why their bullish predictions didn’t quite work out.

Fear, not fundamentals, is running the show

What’s interesting is that not all of this is driven by bad fundamentals. Bitcoin hasn’t suddenly become useless. The tech isn’t broken. And no major hacks have happened this week.

This is about fear, plain and simple.

Markets hate uncertainty, and right now macro conditions are rough. Interest rates are still high. Investors are nervous about global instability. U.S. markets are jumpy in general.

So the moment crypto started showing weakness, people bailed.

Even big firms in New York—hedge funds that dipped their toes into crypto earlier this year—started offloading some of their holdings. Not necessarily because they don’t believe in Bitcoin long-term, but because they needed to reduce risk somewhere, and crypto is always the easiest asset to cut when things get shaky.

Every crash brings opportunity… but not for everyone

Of course, there are always two sides to a market meltdown.

Some big players are treating this as a chance to buy the dip. A few well-known New York investment desks quietly started increasing their Bitcoin exposure while retail investors were selling in fear. Classic strategy: when everyone panics, the patient people shop.

But for everyday investors—people who put a chunk of their paycheck into crypto hoping it would grow calmly—this week has felt like a nightmare. Many say they’re taking a break from looking at charts for a while. Others are wondering if they should sell now and try again later.

The truth is, crypto has always been unpredictable. And weeks like this remind everyone that the ride can get pretty wild.