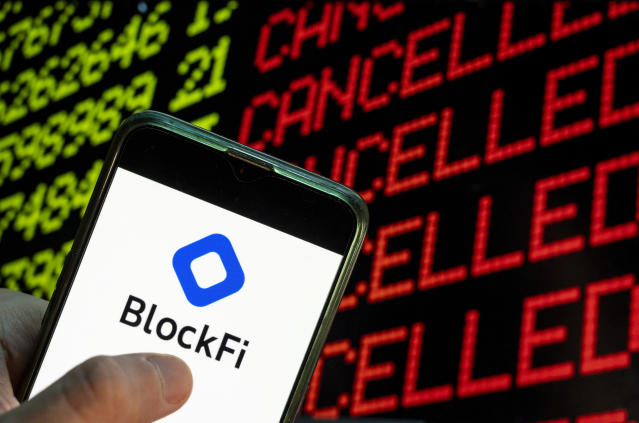

BlockFi, another crypto firm filing for bankruptcy after the FTX disaster

BlockFi announced that it will file for Chapter 11 of the United States Bankruptcy Law, as a consequence of the recent debacle of FTX, one of the most important cryptocurrency exchanges in the world.

The recent FTX debacle has claimed another cryptocurrency firm. We are talking about BlockFi, which has officially filed for bankruptcy, after the possibility was rumored in the early hours of this Monday. Through a press release, the firm assured that it took the measure to “stabilize its business”, and gave indications that it will soon announce layoffs.

BlockFi had suspended withdrawals from its platform on November 11, after FTX announced its bankruptcy. The crypto firm had significant economic exposure to the Sam Bankman-Fried exchange, whose instruments it used to pay interest to its clients. So the sudden fall of the latter was a near fatal blow.

“As part of its restructuring efforts, the Company will focus on recovering all obligations owed to BlockFi by its counterparties, including FTX and associated corporate entities,” BlockFi explained. However, the company acknowledges that the recovery of funds from FTX will not happen anytime soon.

Beyond declaring bankruptcy, BlockFi claims to have almost $257 million, an amount that should be enough to keep some operations active while the restructuring is carried out.

In addition, it has announced the implementation of an internal plan to “considerably reduce costs”, which include cutting labor costs. That is, layoffs. Still, no word yet on how many workers would be affected by the ruling.

BlockFi, another company that suffers the vicissitudes of the crypto winter

The BlockFi case is striking because FTX had been presented as its salvation, and it may end up being its downfall. The firm had suffered a strong shake in the middle of the year, after the collapse of the cryptocurrency market and the Three Arrows Capital debacle, and Sam Bankman-Fried came to its rescue with a loan for 250 million dollars. However, the latter eventually became a loan for 400 million, with the option to be acquired by FTX US.

The debacle of the SBF firm raised great doubts about the situation of BlockFi. Not only because he had part of his assets inside FTX, but also because he had not yet received all the promised loan money. In addition, the company itself indicated that it found out about FTX’s problems through Twitter, like the rest of the world.

According to the documents that BlockFi filed to file for bankruptcy, today it has around 100,000 creditors. The biggest is Ankura Trust Company, to which he owes nearly $730 million; while FTX US appears second with $275 million. And their executives estimate that they have between $1 billion and $10 billion in assets and liabilities.

It is worth mentioning that, just as BlockFi has filed for Chapter 11 of the United States Bankruptcy Law, a subsidiary incorporated in the Bermuda Islands has also initiated a similar process.

In this way, the FTX scandal continues to put other companies on the brink of the precipice. Let’s not forget that Genesis is another of the crypto companies that has taken a hit from its exposure to the exchange in question, and it is rumored that it could also file for bankruptcy.