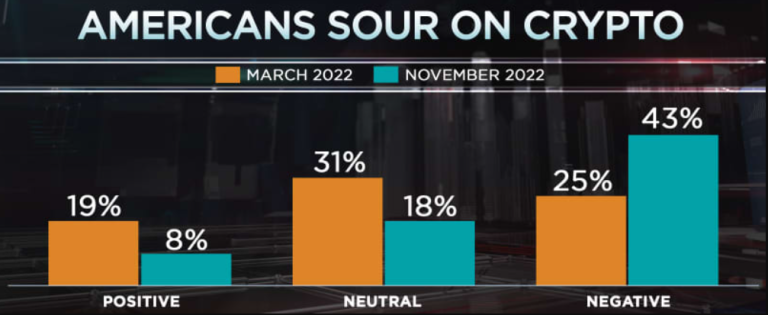

A CNBC survey found that only 8% of Americans have a positive opinion of cryptocurrencies.

A poll by the news outlet CNBC in late November showed that only 8% of Americans have a favorable view of cryptocurrencies. This represents a significant decrease from the 19% positive outlook recorded in March.

The CNBC poll was conducted between November 26 and 30, involving 800 American respondents, with a margin of error of approximately 3.5%.

In addition, along with the decrease in the number of crypto investors with a positive view of cryptocurrencies, CNBC highlighted the increase in negative views of cryptocurrencies, which has increased from 25% in March to 43% in November.

Notably, CNBC noted that the results show “a dramatic drop for an investment that was hyped exponentially” and had a “celebrated coming-out party on the world stage with multiple Super Bowl commercials and celebrity endorsements.”

“That popularity has drawn many ordinary Americans to cryptocurrency and the survey shows that 24% have invested, traded or used cryptocurrency in the past, up from 16% in March,” CNBC added.

Furthermore, the survey also indicated that a large number of crypto investors are also turning against this asset class. This is because 42% of those surveyed indicated having a “somewhat negative or very negative view” of cryptocurrencies.

« The majority of crypto investors have a somewhat or very negative view of crypto assets, aligned with the negative result of 43% of those surveyed. The main difference is that 17% of crypto investors are very negative, compared to 47% of non-crypto investors,”

CNBC highlighted.

The sentiment of traditional investors is decisive in the cryptocurrency ecosystem

It is important to note that the recent survey did not point to any factor as the cause of this negative view of crypto investors. However, the recent collapses of major crypto companies like FTX may have played a role.

In May, Do Kwon-developed stablecoin TerraUSD (UST) pegged to the US dollar unexpectedly crashed, wiping $44 billion off the market. Furthermore, in July, crypto lender Celsius and other major crypto companies went bankrupt, resulting in the disproportionate loss of client funds.

However, the month of November saw the biggest impact on the cryptoecosystem this year, with the collapse of FTX. The world’s third-largest cryptocurrency exchange, FTX, filed for bankruptcy on November 11, removing billions from the crypto market and sending major tokens lower.

Also, in a forum at the CNBC Financial Advisors Summit held this week, the CEO of cryptocurrency exchange Bitfury, Brian Brook, indicated that the cryptocurrency ecosystem “is made up of 90% of the retail market”, therefore traditional investor sentiment is “driving” for the crypto ecosystem.

” When you repeatedly read the FTX stories on the front page of the Wall Street Journal, what it does is scare relatively new entrants .” Brian Brook said. ” And as a result, liquidity is less than it would have been, since people’s willingness to invest is much less ,” he added.

Not everything is pessimism

However, not everyone has a negative outlook on the cryptocurrency ecosystem, especially institutional investors.

According to a Coinbase-sponsored survey published on Nov. 22 and conducted between Sept. 21 and Oct. 27, it was found that 62% of institutional investors who invested in cryptocurrency increased their investments in the last 12 months.

Likewise, 58% of those surveyed expressed that they predicted to increase the exposure of their portfolio to cryptocurrencies in the next three years. Furthermore, almost half of those surveyed “strongly agree” that cryptocurrency prices will increase in the long term.

Notably, the representative sample for the Coinbase survey consisted of 140 institutional investors located in the United States, who collectively have assets under management totaling around $2.6 billion.

Separately, earlier this week, cryptocurrency exchange Bitstamp also claimed that institutional registrations within its digital asset trading platform increased by 57% in November, despite the FTX crash dominating headlines throughout the month. month.