PrimeXBT is a Seychelles-registered cryptocurrency exchange. It was published in 2018.

To be more specific, PrimeXBT is a cryptocurrency derivatives exchange. In other words, you can choose between two things: to be tall or to be short. Going long means betting that a particular cryptocurrency will rise in price, while going short means betting that a particular cryptocurrency will fall in price. For more information on the nature of these types of transactions, see Geared trading.

Is PrimeXBT the best crypto trading platform?

Benefit from

PrimeXBT is a cryptocurrency derivatives exchange. This means that you can basically choose between two things: to be long or to be short. Going long means betting that a particular cryptocurrency will rise in price, and going short means betting that a particular cryptocurrency will fall in price. Learn more about the nature of this type of trading below at Leveraged Trading.

This trading market highlights a number of advantages of its platform on its website. First of all, you can create an account here anonymously and the market does not ask for any personal information. Additionally, the commercial market has a multi-level security system that they claim is industry leading. You can also trade with up to 200x leverage (more on that below).

High liquidity

As of the last update of this review (September 20, 2021), the 24-hour trading volume was close to 4 billion. It has great liquidity and any user planning to open an account on this platform will definitely not have any liquidity issues.

Leveraged trading

PrimeXBT offers leveraged trading on its trading platform. This means that you can receive greater exposure to a certain rise or fall in the price of a cryptocurrency, without having the necessary assets. This is achieved by “delivering” your trade, which in simple terms means you borrow from the trade to invest more.

Let us e.g. say you have $10,000 in your trading account and you invest $100 in BTC by going long (i.e. increasing in value). It does this with 100x leverage. If BTC increases in value by 10%, if you only invested $100, you would have earned $10 just by holding Bitcoin. By investing 100 with 100x leverage, you instead made $1,000 more ($990 more than if you hadn’t made a profit on your trade). On the other hand, if the value of BTC drops by 10%, you have lost $1,000 ($990 more than if you had not made a profit on your trade). So as you can imagine, there is potential for great benefits, but also great downsides…

This image from the PrimeXBT website shows another useful way to show the benefits of leveraged trading in a bull market:

American investors

Why are so many exchanges not allowing US citizens to open accounts? The answer has only three letters: S, E and C (“Securities Exchange Commission”). The reason the SEC is so respected is that the US does not allow foreign companies to solicit US investors unless those foreign companies are also registered in the US (with the SEC). If, despite this, foreign companies solicit American investors, the SEC can prosecute them. There are many examples of SEC lawsuits against cryptocurrency exchanges, such as EtherDelta’s for operating an unregistered exchange. Another example was when they sued Bitfinex claiming that Stablecoin Tether (USDT) misled investors. It is very likely that other cases will arise.

PrimeXBT does not support US investors in their exchange. In addition, investors from the following jurisdictions are also restricted: Canada, Algeria, Ecuador, Ethiopia, Iran, Russian Federation, Syria, North Korea or Sudan, Israel, Japan, United States Small Islands and American Samoa.

PrimeXBT’s business vision

Different forex markets have different trading viewpoints. And there is no “this listing is the best” view. You have to decide for yourself which trading approach suits you best. Common to all views is generally that they all show your order book or at least part of it, a price chart of the chosen cryptocurrency and order history. They also usually have buy and sell charts. Before choosing a profession, try to take a look at its vision to see if it feels right bank, but credit card deposits are no problem. Since credit card deposits are accepted, PrimeXBT is considered an “entry-level exchange”.

However, if for some reason you need to deposit fiat money by bank transfer, you can find one by using our Exchange Directory.

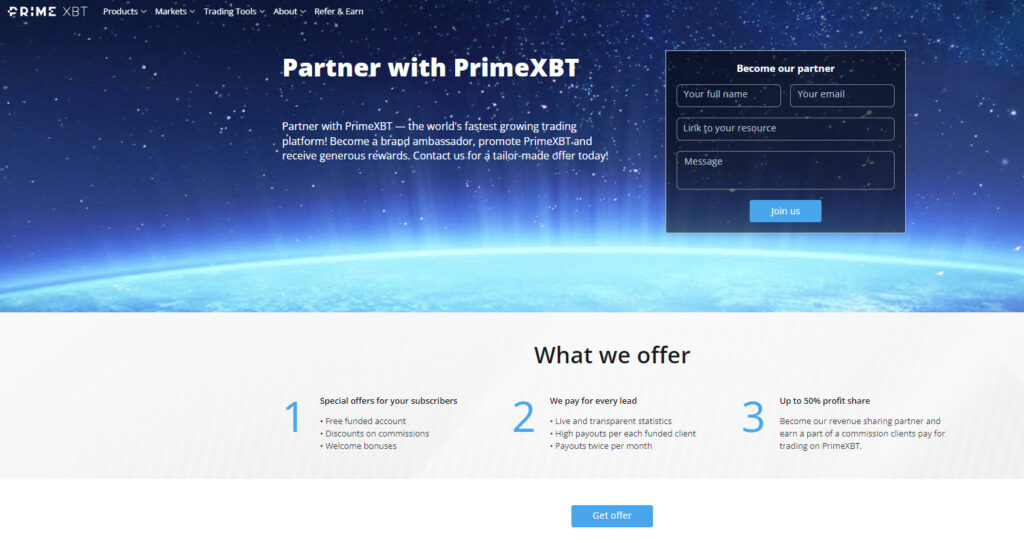

Affiliate program

PrimeXBT also has a lucrative affiliate program with four different levels. This means that you not only earn income from the people you refer directly, but also from referrals from your referrals and referrals from those referrals! The following image explains a little more clearly how it works:

PrimeXBT fees

PrimeXBT trading fees

Many exchanges charge what we call buyer’s fees and maker’s fees to both buyers and producers. Receivers are those who draw liquidity from the order book by accepting already placed orders. Creators are the ones who execute these commands. The first alternative is to simply charge a “flat” fee. Fixed fees mean that the exchange charges the same fees to the buyer and producer.

This exchange offers a fixed commission of 0.05% per trade. According to the industry’s most comprehensive report detailing average contract negotiation fees, the global average fee for buyers and producers was 0.063% for buyers and 0.018% for producers. MoonXBT is thus slightly below average in buyer fees, but slightly above average in producer fees.

Together, these prices are attractive.

PrimeXBT withdrawal fees

Withdrawal fees are another fee to consider before choosing which exchange to trade. It is usually fixed (regardless of the number of cryptocurrency units withdrawn). This varies from cryptocurrency to cryptocurrency.

The global industry average last time we conducted our empirical study was around 0.0006 BTC when BTC was withdrawn. PrimeXBT only charges 0.0005 BTC. As a result, their BTC withdrawal fees are slightly lower than the global industry average.

In general, the prices here are competitive.