Valkyrie Investments has filed a proposal to rescue ailing Bitcoin Trust (GBTC) from Grayscale.

US asset manager “Valkyrie,” which currently oversees more than $180 million, announced Friday a proposal to “sponsor and manage” Grayscale’s Grayscale Bitcoin Trust (GBTC).

The first step to a potential takeover would be the launch of a new hedge fund called the “Valkyrie Opportunistic Fund”. This new investment product will attempt to leverage Grayscale Investments’ (GBTC) existing discount, to offer exposure to digital assets through an “actively managed” hedge fund.

Similarly, Valkyrie’s new product will increase its holdings in GBTC, allowing the company to discover the “true value of underlying Bitcoin to investors.”

“We understand that Grayscale has played an important role in the growth of Bitcoin with the launch of GBTC and we respect the work they have done. However, in light of recent events involving Grayscale and its family of affiliates, it is time for a change and Valkyrie is the best firm to manage GBTC and ensure its investors are treated fairly.” said Steven McClurg, CIO of Valkyrie Investments.

It’s important to note that Valkyrie’s latest move presents a new alternative to Grayscale’s attempts to close the gap with the Regulators. Grayscale, led by Michael Sonnenshein, has been involved in a legal battle with the SEC in an attempt to turn GBTC into a Bitcoin ETF.

“Our proposal represents a significant improvement over GBTC’s current management. We are committed to putting the interests of GBTC’s shareholders first and have the experience and expertise to do so effectively.”

Steven McClurg

Valkyrie’s offering includes GBTC “discounted fees.”

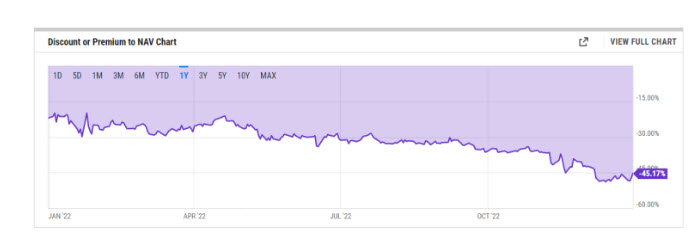

As mentioned above, GBTC is currently trading around 45.17% below the value of the Bitcoin it holds. This is because while new shares can be created, they cannot be destroyed as demand for the underlying Bitcoin of the trust cools, resulting in a discount to the intrinsic value.

Grayscale has tried several times to turn GBTC into an Exchange Traded Fund (ETF), a strategy that would allow him to redeem shares. But the US Securities and Exchange Commission rejected the move in June, prompting Grayscale to file a lawsuit against the agency within hours.

Similarly, Valkyrie pointed to a number of mechanisms to “improve GBTC’s current governance”. Those steps include filing “Regulation M” with the SEC to ease bailouts for investors and reduce fees to “fairer levels.” Furthermore, it will also seek to establish a redemption mechanism that will offer both Bitcoin and cash options to GBTC investors.

On the other hand, the firm also currently monitors some cryptocurrency-focused ETFs, such as the Valkyrie Bitcoin Strategy ETF (BTF). Additionally, Valkyrie said that its “Valkyrie Bitcoin Trust” has been operating on daily liquidity since its creation in January 2021.

However, Valkyrie’s plan may present a difficult task. This is considering that GBTC alone has more than $10 billion in assets and Valkyrie only manages around $180 million in total assets.

In particular, Steven McClurg, who previously masterminded and was involved in investment fund acquisitions and restructurings in his previous role as a managing director at global firm Guggenheim Partners.